Innova Captab Share Price Target: Introduction

Welcome to a comprehensive exploration of Innova Captab share price targets spanning various financial years. This blog aims to provide a thorough analysis of Innova Captab’s business model, offering insights into evaluating price targets with a focus on key risks and benefits. Let’s kick off by gaining a deeper understanding of Innova Captab’s unique business model.

Table of Contents

Business Model of Innova Captab

In the ever-evolving landscape of the Indian pharmaceutical industry, one name stands out prominently – Innova Captab Limited. This rising star has not only caught the eye of investors with its recent IPO but has also become a beacon of success. So, what’s the magic behind their triumph? Let’s unravel the intricacies of Innova Captab’s business model.

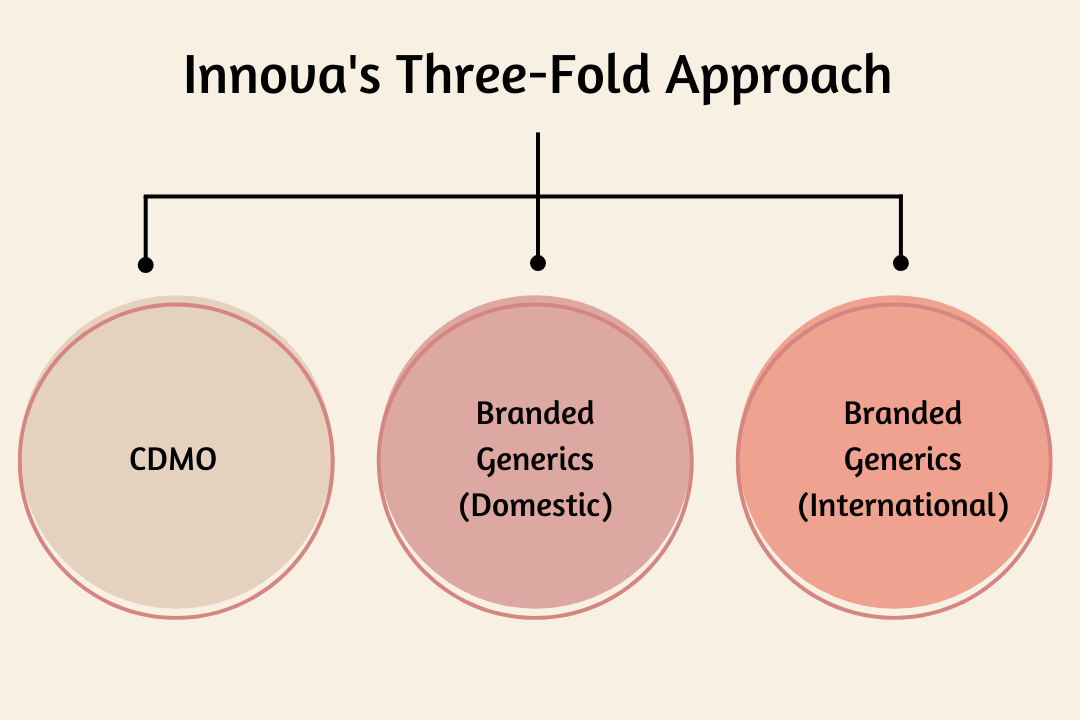

Innova Captab doesn’t play a singular hand; it boasts a three-pronged strategy that sets it apart in the pharmaceutical arena.

- Contract Development and Manufacturing (CDMO): Positioned as the 2nd largest Domestic Formulations CDMO in India, Innova plays a pivotal role as a manufacturing partner. They offer comprehensive services, from formulation development to packaging and distribution, supporting other pharmaceutical companies in bringing their drugs to market.

- Branded Generics (Domestic): Innova carves a niche in the Indian market by providing high-quality, affordable medicines. With a focus on therapeutic areas like cardiovascular and anti-diabetic, they’ve built a robust network of over 150,000 Indian retailers.

- Branded Generics (International): Innova’s reach extends beyond borders, exporting their branded generics to various countries. Their facilities comply with international standards such as GMP, WHO, and EU-GMP, ensuring the global accessibility of their pharmaceutical offerings.

The Product Palette: A Rainbow of Pharmaceuticals

Innova’s product portfolio is nothing short of impressive, covering a spectrum of pharmaceutical forms – tablets, capsules, dry syrups, injections, ointments, and liquid medicines. This diversity not only meets varied healthcare needs but also contributes to a steady stream of revenue.

Beyond Pills: The Significance of R&D

Recognizing the pivotal role of research and development (R&D), Innova Captab invests substantially in this arena. Their commitment to in-house R&D positions them at the forefront of innovation, consistently bringing new drugs to market and fortifying their branded generic pipeline.

The Winning Formula: Ingredients of Success

What fuels Innova’s success? It’s a concoction of strategic elements:

- Diversification: The three-pronged business model ensures stability and mitigates risks.

- Strong R&D: Innovation remains at the core, keeping them ahead of industry trends.

- Quality Focus: International certifications like GMP guarantee top-tier products.

- Efficient Operations: Streamlined processes translate into cost savings and sustained profitability.

- Experienced Management: A seasoned leadership team navigates the complexities of the pharmaceutical landscape with expertise.

These were some of the major nuances of the business model. Now, let’s discuss the significant risks of investing in the company.

Major Risks of Investing in Innova Captab

Before we jump on the analysing Innova Captab Share Price Target, it’s crucial to understand the potential pitfalls alongside the promise. Let’s take a walk on the riskier side of Innova Captab’s:

- Fierce Competition

The Indian CDMO market is no stranger to cutthroat competition, with industry giants like Torrent Pharma, Zydus, Cadila vying for the top spot. The threat of price wars and client poaching looms large, creating a challenging environment that could potentially squeeze Innova’s profitability margins. - Regulatory Burden

In the pharmaceutical realm, regulatory adherence is paramount. The industry is on the razor’s edge of stringent regulations. Any misstep in compliance, quality assurance, or production protocols can spell disaster, inviting hefty fines, reputational damage, and the risk of losing valuable contracts. - Customer Dependence

Innova’s branded generics segment places a significant reliance on a handful of key customers. The vulnerability arises if any of these crucial partnerships sour, posing a potential threat to the company’s financial stability. - Price Pressure

While the commitment to affordable medicines is commendable, the pressure to keep prices low may limit profit margins. This, in turn, can impede investments in crucial areas like research and development (R&D), posing a long-term challenge to sustainable growth. - Brand Building is a Marathon

Building brand recognition for generic drugs is no sprint; it’s a marathon. Success in a market saturated with similar options is far from guaranteed and demands substantial investment and time, presenting a formidable challenge for Innova. - Geopolitical Ups and Downs

The global landscape introduces its own set of challenges. Supply chain disruptions and fluctuations in raw material prices, driven by geopolitical events, can wreak havoc on Innova’s operations and upset carefully calculated cost projections. - Continuous R&D

Investing in research and development is a risky endeavor. The journey from concept to market is fraught with uncertainties, with not all drugs making it to the finish line. This inherent risk places a strain on finances and can lead to unexpected losses.

Compelling Advantages of Investing in Innova Captab Limited

Let’s delve into the key benefits and unique advantages that position Innova Captab as a compelling investment opportunity.

- Market Leader in CDMO:

Innova Captab proudly claims its spot as the 2nd largest Domestic Formulations CDMO player in the thriving Indian market. With outsourcing becoming a strategic mantra for pharmaceutical giants, Innova stands at the forefront, perfectly positioned to capitalize on this industry trend. - Sticky Contracts for Predictable Revenue:

Long-term CDMO contracts spanning 2 to 5 years provide Innova with predictable revenue streams, shielding the company from market fluctuations. These enduring contracts also foster robust client relationships, ensuring repeat business and fostering stable, long-term growth. - Diversification for Stability:

In the world of CDMO, Innova serves a diverse clientele with varied needs. This intentional diversification reduces dependence on any single client or therapeutic area, thereby mitigating risk and providing a stable foundation for sustained growth. - Dual Engine Strategy:

Innova’s prowess extends beyond being a contract manufacturer. The company actively participates in the branded generics game, marketing its own affordable medicines in both the domestic and international markets. This dual-engine strategy not only fuels further growth but also reduces reliance on CDMO alone. - High Profit Margins from Branded Generics:

The branded generics segment offers higher profit margins compared to pure manufacturing, elevating profitability for Innova. This financial advantage provides room for strategic reinvestment in research and development (R&D) initiatives and facilitates expansion. - Strong Distribution Network:

With a reach extending to over 150,000 Indian retailers, Innova ensures efficient distribution and market penetration. This robust distribution network translates into tangible market share gains and sustained sales growth. - R&D Focus and Product Pipeline:

Innova places a significant emphasis on in-house research and development, consistently innovating and expanding its branded generic portfolio. This proactive approach not only keeps the company ahead of industry trends but also fuels future growth. A strong pipeline of new drugs underscores the long-term potential for investors. - Future Markets and International Presence:

Innova’s international footprint positions the company for further expansion into new markets, unlocking additional revenue streams and growth opportunities beyond the borders of India. - Growth Potential in Thriving Markets:

With the Indian pharma market and the global CDMO space projected for significant growth, Innova Captab is strategically positioned to capitalize on these upward trends, promising investors ample opportunities for growth.

Financial Highlights and Peer Comparison

| Parameter | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 |

|---|---|---|---|---|---|

| Sales (Rs. Crores) | 356 | 373 | 411 | 801 | 926 |

| Operating Profit (Rs. Crores) | 41 | 51 | 54 | 96 | 114 |

| Net Profit (Rs. Crores) | 20 | 28 | 34 | 64 | 68 |

| EPS (Rs.) | 165.67 | 232.42 | 287.50 | 532.92 | 14.16 |

| OPM (%) | 11 | 14 | 13 | 12 | 12 |

| Interest (Rs. Crores) | 6 | 5 | 4 | 6 | 20 |

| Tax Rate (%) | 20 | 26 | 26 | 25 | 26 |

| Equity Capital (Rs. Crores) | 12 | 12 | 12 | 12 | 48 |

| Borrowings (Rs. Crores) | 72 | 54 | 46 | 199 | 190 |

| Total Liabilities (Rs. Crores) | 223 | 245 | 370 | 575 | 704 |

Analysis and Observations:

- Sales Growth: Innova Captab has shown consistent growth in sales over the years, with a significant surge from 2019 to 2023, nearly doubling.

- Profitability: Operating Profit Margin (OPM) has been relatively stable around 12-14%, indicating consistent operational efficiency. The operating profit and net profit both show an upward trend.

- Earnings per Share (EPS): There’s a substantial increase in EPS, reaching its peak in 2022 and then witnessing a sharp decline in 2023, potentially due to a significant increase in the number of equity shares.

- Interest and Borrowings: There is a notable increase in interest payments and borrowings, indicating an elevated need for external funds, potentially for expansion or working capital requirements.

- Tax Rate: The tax rate has remained relatively stable, hovering around 25-26%, suggesting consistent tax planning.

- Equity Capital: There’s a substantial increase in equity capital in 2023, potentially due to corporate actions such as bonus issues or rights offerings.

- Total Liabilities: The total liabilities have seen a consistent increase, reflecting the growth and financial commitments of the company.

- Balance Sheet Composition: The balance sheet indicates a healthy mix of fixed assets, current liabilities, and other assets, suggesting a well-managed financial structure.

Peer Comparisons:

| S.No. | Name | CMP Rs. | P/E | Mar Cap Rs.Cr. | ROCE % |

|---|---|---|---|---|---|

| 1. | Sun Pharma | 1247.50 | 33.45 | 299292.97 | 16.44 |

| 2. | Cipla | 1244.95 | 28.29 | 100531.43 | 18.02 |

| 3. | Dr Reddy’s Labs | 5632.15 | 18.43 | 93855.32 | 26.73 |

| 4. | Mankind Pharma | 1925.75 | 54.68 | 77205.21 | 20.70 |

| 5. | Zydus Lifesciences | 676.20 | 21.90 | 68445.24 | 14.96 |

| 6. | Aurobindo Pharma | 1063.65 | 26.42 | 62337.97 | 9.20 |

| 7. | Alkem Lab | 4972.50 | 39.67 | 59530.01 | 13.67 |

| 8. | Innova Captab | – | 17.59 | 233.24 | – |

Innova Captab Share Price Target 2024-2030

Innova Captab Share Price Target 2024

In 2024, Innova Captab appears poised for a strong financial performance, with our analysis forecasting an expected share price of INR 711. This projection reflects a positive outlook, hinting at potential growth and value for investors entering the market that year.

Innova Captab Share Price Target 2025

As we progress into 2025, the optimistic trend continues, with the anticipated share price reaching INR 779. This suggests a sustained upward trajectory for Innova Captab, potentially driven by factors such as market dynamics, industry trends, and the company’s strategic initiatives.

Innova Captab Share Price Target 2026

In 2026, our analysis envisions a further increase in the share price, with an estimated value of INR 854. This positive projection signals continued market confidence and may indicate the successful execution of the company’s business strategies.

Innova Captab Share Price Target 2027

Moving into 2027, the outlook remains favorable, with an expected share price of INR 933. This projection suggests that Innova Captab is well-positioned to navigate market challenges and capitalize on opportunities, contributing to its overall growth.

Innova Captab Share Price Target 2028

As we approach 2028, the company’s resilience is reflected in the projected share price of INR 1,024. This milestone suggests that Innova Captab continues to deliver value to its shareholders and maintain a positive trajectory in the pharmaceutical sector.

Innova Captab Share Price Target 2029

In 2029, the anticipated share price climbs to INR 1,128, underscoring the company’s potential for robust financial performance. This positive projection may be influenced by factors such as market demand, product innovation, and strategic business decisions.

Innova Captab Share Price Target 2030

Looking towards 2030, our analysis foresees a share price of INR 1,239, reinforcing the notion of sustained growth for Innova Captab. These projections provide valuable insights for investors seeking to navigate the evolving landscape of the pharmaceutical industry.

Conclusion

As we conclude our examination of Innova Captab share price targets spanning various financial years, it becomes evident that the pharmaceutical landscape holds a myriad of opportunities and challenges.

The projections we’ve explored provide a glimpse into the potential growth trajectory of Innova Captab, offering valuable insights for investors and stakeholders. We post these kinds of price predictions regularly on our website.

Disclaimer: The share price targets discussed are based on analysis and projections, and actual market conditions may vary. Investors are advised to conduct thorough research and consider individual risk tolerance before making any financial decisions.