Jyoti CNC GMP – Introduction

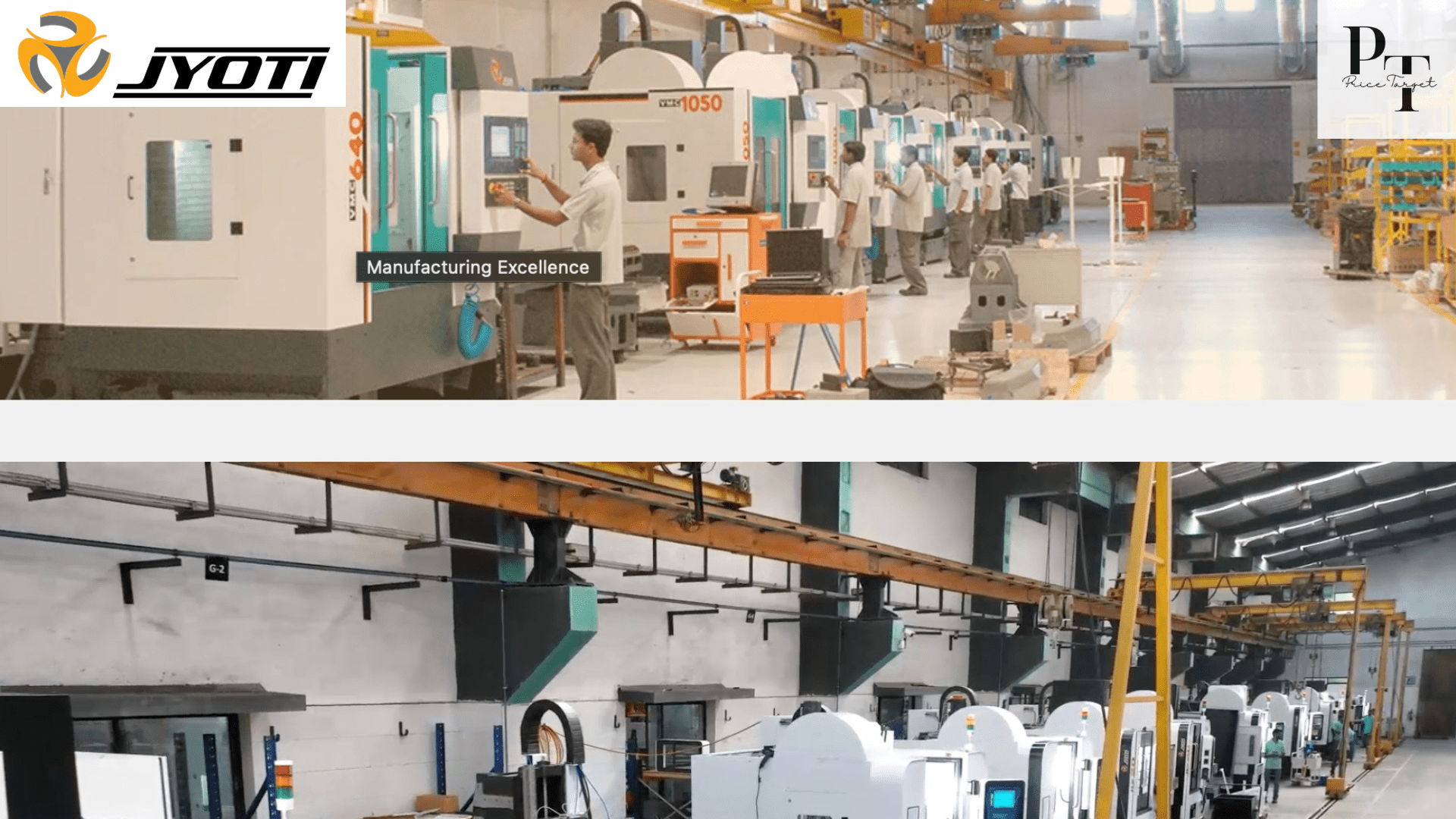

The Indian machine tool industry is witnessing a major horsepower boost with Jyoti CNC Automation Limited‘s much-anticipated Initial Public Offering (IPO) gearing up for takeoff. This leading manufacturer of CNC machines has carved a niche for itself, establishing a reputation for precision, reliability, and innovation.

As investors fasten their seatbelts for the IPO, two key questions hover in the air: What listing price can we expect, and is there a grey market premium waiting to be unleashed? Buckle up, as we delve into the engine room of Jyoti CNC GMP and explore these crucial aspects.

From Gearbox Guru to CNC Champion:

Jyoti’s narrative unfolded in 1961, not amidst the sleek marvels of CNC technology, but rather through the production of robust gearboxes designed for textile machines. At that time, India’s industrial landscape was in its nascent stages, and Jyoti, under the guidance of the visionary duo Shri Valjibhai M. Patel and Shri Kantilal M. Patel, emerged as a significant contributor to this evolving industrial growth. Their gearboxes, known for their durability and precision, garnered a devoted following, laying the groundwork for the company’s subsequent expansion.

In the 1980s, a technological revolution dawned with the introduction of Computer Numerical Control (CNC) machines. Recognizing the transformative potential of this technology, Jyoti embarked on a bold venture in 1983 by entering the CNC arena. Starting with CNC turning centers and progressively diversifying their product range, this strategic move proved to be pivotal. It propelled Jyoti into the forefront of the automation era, charting a course for their future success.

A Symphony of Innovation:

Jyoti’s unwavering commitment to innovation resonates throughout every aspect of its operations. At the heart of this dedication lies a cutting-edge Research and Development center, staffed by skilled engineers continually pushing the boundaries of technology. This commitment has resulted in a continuous flow of groundbreaking advancements, including:

- Pioneering 5-Axis Machining in India: Jyoti proudly holds the distinction of being the first Indian company to manufacture and introduce 5-axis CNC machines to the market. These machines showcase the capability for intricate multi-directional machining tasks, solidifying Jyoti’s leadership position in pioneering technology.

- Developing Customized Solutions: Recognizing the diversity of customer needs, Jyoti prides itself on offering tailor-made machines and comprehensive technical support. The company understands that a one-size-fits-all approach is insufficient, and its ability to provide customized solutions sets it apart.

- Embracing Automation: Jyoti, acknowledging the pivotal role of automation in enhancing efficiency, has seamlessly integrated robotics and advanced manufacturing systems into its production processes. This not only elevates productivity but also ensures a consistent level of quality and precision across its products. The embrace of automation underscores Jyoti’s commitment to staying at the forefront of technological advancements in the industry.

The IPO Engine: Fueling Growth and Innovation

With a proven track record and a future brimming with potential, Jyoti CNC has set its sights on the IPO runway. This influx of capital will fuel their ambitious growth plans, including:

- Expanding their manufacturing capacity: Jyoti CNC aims to ramp up production to meet the burgeoning demand for CNC machines in India and abroad.

- Strengthening their R&D prowess: Innovation is the lifeblood of Jyoti CNC. The IPO funds will be directed towards developing cutting-edge CNC technologies and solidifying their position at the forefront of the industry.

- Forging deeper market penetration: Jyoti CNC’s sights are set on global expansion. The IPO will provide the resources to establish a stronger international presence and tap into new markets.

Decoding the Jyoti CNC GMP

The air around Jyoti CNC’s IPO crackles with anticipation, and two key questions hang heavy in the air: What price will it debut at, and is there a hidden treasure chest waiting in the grey market? Let’s unravel the whispers and expert speculations to paint a clearer picture.

First, the Jyoti CNC GMP, that clandestine playground where shares exchange hands before the official launch, is already abuzz with excitement. Jyoti CNC’s GMP (Grey Market Premium), the premium unofficial buyers are willing to pay, has reached feverish heights, ranging from 25% to 35%.

Now, let’s shift gears to the official stage, where analysts pore over Jyoti CNC’s financials and future plans. Their meticulous crunching has yielded predictions of a listing price between Rs. 410 and Rs. 450 per share. This range reflects the company’s impressive track record, robust financials, and promising growth potential. While not as stratospheric as the grey market suggests, it still paints a rosy picture for long-term investors seeking a stake in a thriving machine tool giant.

Ultimately, both the grey market murmurs and analyst forecasts are just pieces of the puzzle. Deciding whether to invest in Jyoti CNC’s IPO requires careful consideration, deep research, and a healthy dose of risk assessment. Buckle up, weigh the whispers against the official predictions, and remember, in the end, the IPO’s grand entrance will be a show you won’t want to miss!

Investing in Jyoti CNC: Fasten Your Seatbelts for a Thrilling Ride?

Deciding whether to invest in Jyoti CNC’s IPO requires careful consideration. While the company’s strong fundamentals and growth potential are enticing, remember that the IPO market is a dynamic beast. Here are some factors to weigh in your decision-making:

- Risk appetite: The Indian IPO market can be volatile. If you’re a risk-averse investor, consider your tolerance for potential fluctuations before diving in.

- Long-term vision: Jyoti CNC is a solid company with a promising future. If you’re looking for a long-term investment with the potential for substantial returns, this IPO might be worth a closer look.

- Market sentiment: Keep an eye on the overall market sentiment and the performance of other IPOs in the machine tool sector. Positive indicators may boost your confidence in Jyoti CNC’s success.

Ultimately, the decision to invest in Jyoti CNC’s IPO is a personal one. Be sure to conduct thorough research, consult with financial experts, and weigh the risks and rewards before making a call.

Jyoti CNC’s IPO promises to be a major event in the Indian machine tool industry, potentially revving up investor engines across the nation. Whether you’re a seasoned investor or just starting your journey, buckle up, fasten your seatbelts, and stay tuned for the exciting ride ahead.

In conclusion, Jyoti CNC Automation Limited is more than just a manufacturer of CNC machines. It is a symbol of Indian industrial ambition, a testament to the power of innovation, and a beacon of hope for a future where technology shapes progress and fuels the dreams of a nation.

Read other blogs on our website and read price targets.