Nova AgriTech IPO Grey Market Premium – Introduction

The Indian agricultural sector is currently going into a massive change, and Nova AgriTech Limited (NAgTL) is one such company that aims to be at the forefront of this transformation. With its upcoming IPO on the horizon, the company has grabbed the attention of various investors who are interested into agritech space.

As a retail investor, should you invest in the share which may seems to give a promising returns? Let’s delve deeper into Nova AgriTech IPO Grey market premium, other IPO details, and the Business Model of the company to see whether investing in the compnay is a valuable opportunity or a potential problem.

Nova AgriTech NAgTL: Business Model

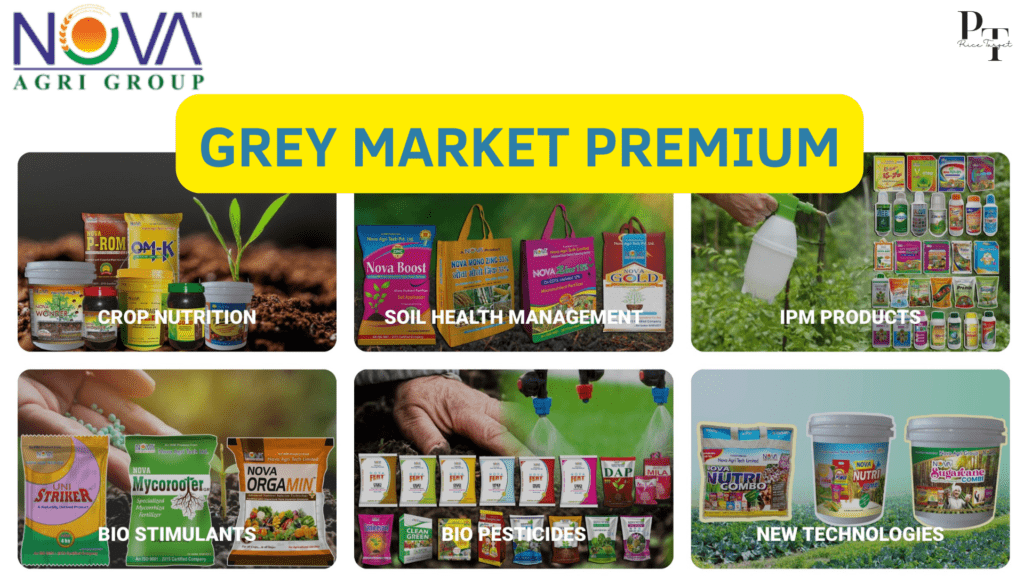

Established in 1997, Nova AgriTech Limited (NAgTL) is a leading player in India’s agritech sector. Unlike the traditional approach of one-size-fits-all, NAgTL focuses on a unique three-pronged strategy, of crop protection, specialty fertilizers, and micro irrigation systems. Let’s delve deeper into each of these branches and discover how the company is nurturing a more sustainable and productive agricultural landscape:

1) Crop protection:

Through its subsidiary Nova Agri Sciences, the company manufactures a diverse range of crop protection products including insecticides, pesticides, herbicides and fungicides. Currently the company has over 629 product registrations, catering to various needs of the farmers like soil health, crop nutrition, and bio-pesticide.

Recognizing the importance of holistic soil health, the company also offer products that helps nourish crops in the ground. This includes organic fertilizers having beneficial microbes, targeted micronutrient supplements, and bio-pesticides.

2) Specialty fertilizers:

Just like humans, plants also have specific dietary needs that depends on their individualities and environments. The company understands this crucial concept and has carved its niche into specialty fertilizers.

Their dedicated team of scientists continuously crafts unique formulations catering to specific crop requirements and soil conditions to help the crop and soil in short and long run. Example, Imagine a fertilizer blend specially concocted for Watermelon trees growing in the sandy soils of Rajasthan, or special solutions designed for rice plants thriving in the fertile deltas of Bihar. This targeted approach not only optimizes yields but also minimizes environmental impact in long run.

3) Micro irrigation systems:

Water scarcity is a increasing threat to agriculture worldwide. Identifying this issue, NAgTL has emerged as a leader of water conservation through its micro-irrigation systems. Drip irrigation systems, like tiny veins delivering life-giving water directly to the roots, and efficient sprinkler systems that mimic gentle rain, are just a few weapons in NAgTL’s water-saving solutions.

Their systems not only minimize water wastage but also ensure precise delivery of water and nutrients exactly where they’re required the most. This translates to healthier crops, better productivity, and reduced dependence on freshwater resources.

Nova AgriTech IPO Grey Market Premium:

NAgTL is gearing up for an IPO, aiming to raise nearly Rs. 140 crores through a fresh issue and an offer for sale of approximately 77.58 lakh shares. While the price band and dates are yet to be officially announced, the grey market is already in buzz with whispers of a good premium.

Market analysts are speculating a grey market premium that is ranging from 15% to 45%. This grey market premium is emerging as a key focal point for potential investors, sparking enthusiasm and increased interest in the financial community. This analysis was made by one of the prominent analyst on his instagram portal.

Disclaimer: However, it’s crucial to remember that these are mere speculations, and the actual picture might differ.

Conclusion: Nova AgriTech IPO Grey Market Premium

By empowering farmers with the tools and knowledge to nurture their crops sustainably, NAgTL is contributing to a more secure and abundant future for all. As an investor, we are excited to see how their upcoming IPO unfolds and how their innovative solutions continue to shape the Indian agricultural landscape. Thank you for reading this blog. Also read other blogs by visiting our website.