📘 Table of Contents

- Overview

- Business Snapshot

- Historical Share Price Trend

- Strategic Growth Drivers

- Financials Summary Table

- Year-wise Share Price Forecast (2026–2040)

- Peer Comparison Table

- SWOT Analysis

- Key Risks

- Final Verdict

- FAQs

✅ 1. Quick Overview – Reliance Industries Share Price Target

| Parameter | Detail |

|---|---|

| Company Name | Reliance Industries Limited |

| NSE Ticker | RELIANCE |

| BSE Code | 500325 |

| Sector | Conglomerate |

| Market Cap (2025) | ₹20 lakh crore approx. |

| Promoter Holding | 50% |

| Dividend Yield | 0.34% |

| Headquarters | Mumbai, India. |

🧭 2. Business Snapshot

Reliance Industries is a multi-sector conglomerate engaged in energy, petrochemicals, telecom, retail, digital services, and green energy. With its transformation over the last decade, Reliance is shaping into a tech-driven clean energy and consumer powerhouse.

📈 3. Historical Share Price Trend

| Year | Share Price (₹) | Key Event |

|---|---|---|

| 2015 | Starting around ₹220, it had some dips and rallies, closing the year around ₹250-₹255. | Telecom ambitions emerge |

| 2020 | Beginning around ₹747.71, the stock saw a sharp decline in March to approximately ₹499.27 due to the pandemic, but then surged remarkably through the year, closing around ₹992.65. | Jio Platforms fundraising (Facebook, Google) |

| 2022 | Opening around ₹1201.93, RIL’s share price saw a peak around April 2022 at approximately ₹1409.93, followed by some corrections, eventually closing the year around ₹1273.6. | Retail and digital expansion |

| 2025 | Starting the year around ₹1215.15 (December 31, 2024 closing), Reliance Industries’ share price has been on an upward trend. As of July 15, 2025, it is trading around ₹1488.5, showing good recovery from its 52-week low of approximately ₹1114.85 (April 7, 2025). | Green energy pivot strengthens |

🚀 4. Strategic Growth Drivers (2026–2040)

| Growth Area | Initiatives | Timeline | Impact |

|---|---|---|---|

| Green Energy | Hydrogen, solar gigafactories | 2026–2035 | High |

| Digital | Jio 5G, AI/Cloud services | 2025–2030 | Medium–High |

| Retail | Acquisitions, omni-channel, IPO | 2026–2029 | Very High |

| Petrochemicals | Global expansion, cost optimization | Ongoing | Stable |

| Global Alliances | Tech and energy collaborations | 2025 onward | High |

💰 5. Financial Snapshot (as of FY25)

| Financial Metric | Value |

| Revenue | ₹9.65 lakh crore |

| EBITDA | ₹1.83 lakh crore |

| Net Profit | ₹81,309 crore |

| EPS | ₹51.47 |

| Debt-to-Equity | 0.41 |

| ROE | 9% |

| Free Cash Flow | (Negative) |

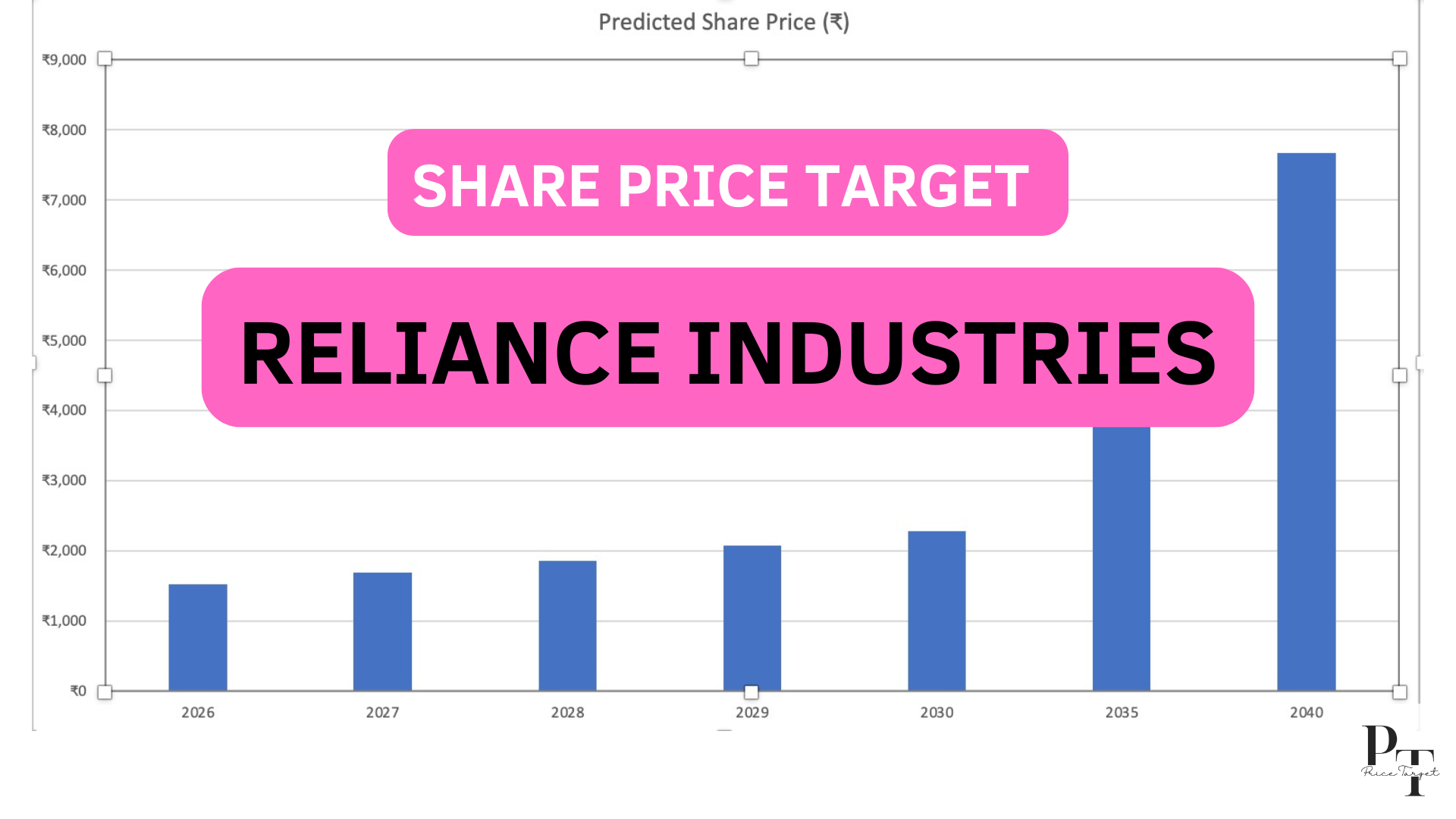

📊 6. Year-wise Share Price Forecast (2026–2040)

| Year | Predicted Share Price (₹) | Key Assumptions |

|---|---|---|

| Reliance Industries Share Price Target 2026 | ₹1519 | Renewable energy rollout |

| Reliance Industries Share Price Target 2027 | ₹1689 | Jio 5G monetization |

| Reliance Industries Share Price Target 2028 | ₹1861 | Retail IPO speculated |

| Reliance Industries Share Price Target 2029 | ₹2073 | Margin expansion via digital |

| Reliance Industries Share Price Target 2030 | ₹2285 | Green hydrogen scaled |

| Reliance Industries Share Price Target 2035 | ₹4204 | Carbon neutrality reached |

| Reliance Industries Share Price Target 2040 | ₹7672 | Global leader in new energy |

Disclaimer: All figures are projections based on publicly available information and personal estimates. Please consult a SEBI-registered financial advisor before making any decision

📊 7. Peer Comparison (2025 Benchmark)

| Company | Market Cap (₹ Cr) | P/E | EPS (₹) | Focus Areas |

| Reliance | ₹20.70 lakh Cr | 24.87 | ₹51.47 (approx. from last FY, current TTM is ₹80,787 Cr / Market Cap to get EPS would be Market Cap / shares outstanding) | Conglomerate (O2C, Retail, Telecom, New Energy, Media) |

| Adani Green | ₹1,61,593 Cr | 103.78 | ₹9.66 (approx. from last TTM data) | Renewables (Solar, Wind, Hybrid Power) |

| Tata Power | ₹1,26,758 Cr | 31.83 | ₹12.43 | Power Generation (Conventional & Renewable), Transmission & Distribution, EV Charging, Solar Manufacturing |

| Bharti Airtel | ₹11,70,672 Cr | 34.89 | ₹55.06 | Telecom (Mobile, Broadband, DTH, Enterprise Solutions), Digital Services |

| ITC | ₹5,22,044 Cr | 26.6 | ₹14.88 (approx. from TTM data) | FMCG (Cigarettes, Foods, Personal Care), Hotels, Paperboards, Agri-Business |

🧠 8. SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Diversified revenue streams | High capital intensity |

| Market leader in telecom & retail | Legacy oil dependence (declining) |

| Strong leadership & global alliances | Execution risk in new ventures |

| Opportunities | Threats |

|---|---|

| Green energy, AI, and EV | Regulatory hurdles |

| Retail and Jio IPOs | Competitive disruption |

| Rural & international expansion | Global economic shocks |

⚠️ 9. Key Risks to Consider

| Risk Type | Description |

|---|---|

| Regulatory | Telecom, retail, ESG policies |

| Execution | Green energy timeline delays |

| Debt Risk | High upfront capex for new projects |

| Competition | Tech, retail, and energy disruptors |

| Global | Oil prices, inflation, foreign capital pullouts |

🧾 10. Final Verdict: Is Reliance a 2040 Bet?

With India projected to become the third-largest economy by 2030, companies like Reliance are positioned to drive and benefit from that growth. From powering homes with solar energy to digitizing villages through Jio, Reliance’s vision isn’t just ambitious — it’s transformational.

🧩 Our Take:

If executed well, Reliance may evolve into India’s Apple + ExxonMobil + Amazon, rolled into one. For long-term investors, it presents a balanced mix of value, growth, and innovation.

❓ 11. FAQs

Q1. Will Reliance’s green energy bet pay off?

A: With huge investments and government support, it’s one of India’s biggest clean energy transitions.

Q2. Will Reliance Retail go public by 2030?

A: Multiple signals and past fundraising suggest a high likelihood by 2028–2029.

Q3. What return can investors expect by 2040?

A: Assuming 12–14% CAGR, the stock could potentially 3–4x by 2040.

📌 Final Note

Disclaimer: All figures are projections based on publicly available information and personal estimates. Please consult a SEBI-registered financial advisor before making in

Do read our other blogs on our website!

1 thought on “Reliance Industries Share Price Target (2026–2040)”

Comments are closed.